by Mike Maharrey

After running the third-largest budget deficit in history in fiscal 2024, the Biden administration kicked off fiscal 2025 in a similar manner.

The federal government ran a $257.45 billion budget shortfall to start the new fiscal year, with revenue down and spending up, according to the latest statement from the Department of Treasury.

That was a 287 percent increase over the October 2023 deficit.

Federal receipts came in at $326.77 billion. That was down about 19 percent compared to October 2023. A one-time influx of tax payments deferred due to wildfires last year boosted October 2023 revenues.

As has been the case for months, the big problem is on the spending side of the ledger.

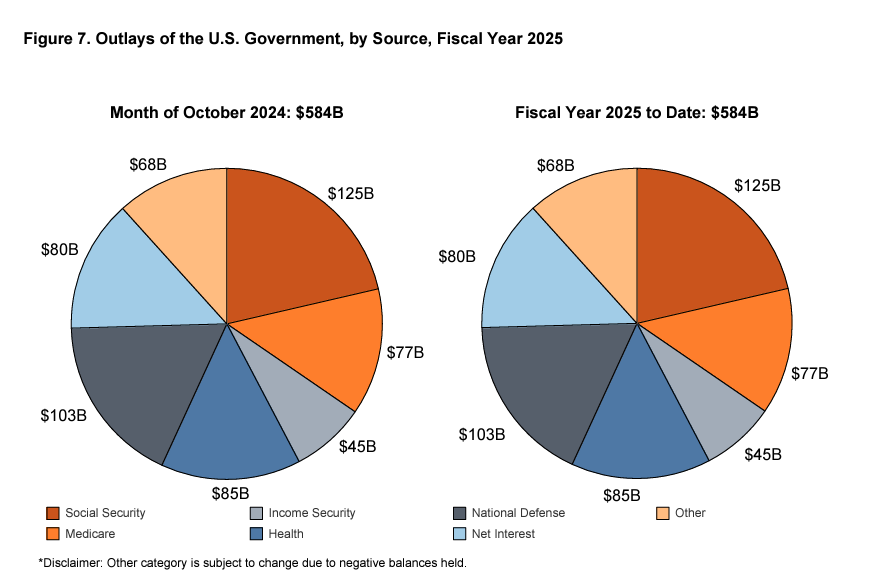

The Biden administration blew through $584.22 billion last month. That was a 24 percent year-on-year increase. Outlays for Social Security, Medicare, and national defense all increased.

You might recall that President Biden promised that the [pretend] spending cuts would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act).

That never happened.

The federal government continues to find new reasons to spend money, whether for natural disasters at home or wars overseas. The Biden administration spent a staggering $6.75 trillion in fiscal 2024, a 10 percent increase over 2023 outlays.

The federal government spent $82 billion on interest expenses last month. That was a modest 8 percent decline, the first annual drop in interest expense since August 2023. The Treasury Department said the decline was driven by a $12 billion reduction in payouts for inflation-protected securities thanks to a lower CPI.

Net interest expense came in at $80 billion. That was a $4 billion increase over October 2023.

Uncle Sam paid $1.13 trillion in interest expense in fiscal 2023. It was the first time interest expense has ever eclipsed $1 trillion.

Interest payments were up 28.6 percent over fiscal 2023 levels.

Don’t let the small decline in interest expense last month fool you. The general trend remains upward. Even with the recent Federal Reserve rate cuts, Treasury yields are pushing upward as demand for U.S. debt sags. Since Trump’s electoral victory, the yield on the 10-year Treasury is up 15 basis points.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates.

Impact of the Debt

We see these big deficits month after month, but most people don’t bat an eye. There seems to be a sense that spending more than you take in month after month isn’t really a problem.

But anybody who says “deficits don’t matter” is deluded.

As the Bipartisan Policy Center points out, the growing national debt and the mounting fiscal irresponsibility undermine the dollar.

“Confidence in U.S. creditworthiness may be undermined by a rapidly deteriorating fiscal situation, an increasing concern with federal debt set to grow substantially in the coming years.”

This could lead to lower economic growth, higher unemployment, and less investment wealth.

Lack of confidence in the U.S. fiscal situation could also lower demand for U.S. debt. This would force interest rates on U.S. Treasuries even higher to attract investors, exacerbating the interest payment problem.

The national debt continues to spiral upward at a dizzying pace. It will officially top $36 trillion within days. According to the national debt clock, that represents 122.85 percent of GDP. Studies have shown a debt-to-GDP ratio of over 90 percent retards economic growth by about 30 percent.

The debt will likely be one of the biggest problems facing President Trump as he takes the reins of power. With Republicans controlling both chambers of Congress and the White House, there is an opportunity to tackle the spending problem, but whether the GOP has the political will to make substantial cuts remains to be seen.